What is GRI and How It Can Affect Your HS Classification

This article will guide anyone who wants to classify Harmonized System (HS) Codes, by explaining about the General Rules of Interpretation (GRI) and how it can be used as a guideline to help you classify your goods.

What Is the General Rules of Interpretation (GRI)?

The GRI are a set of 6 rules used to identify products. To ensure a uniform legal understanding of the HS Nomenclature, these rules need to be applied in sequential order.

For example: If GRI Rule 1 cannot be applied to the classification of a product, only then we move on to GRI Rule 2, then if GRI Rule 2 cannot be applied we will move on to GRI Rule 3, etc.

GRI Rule 1

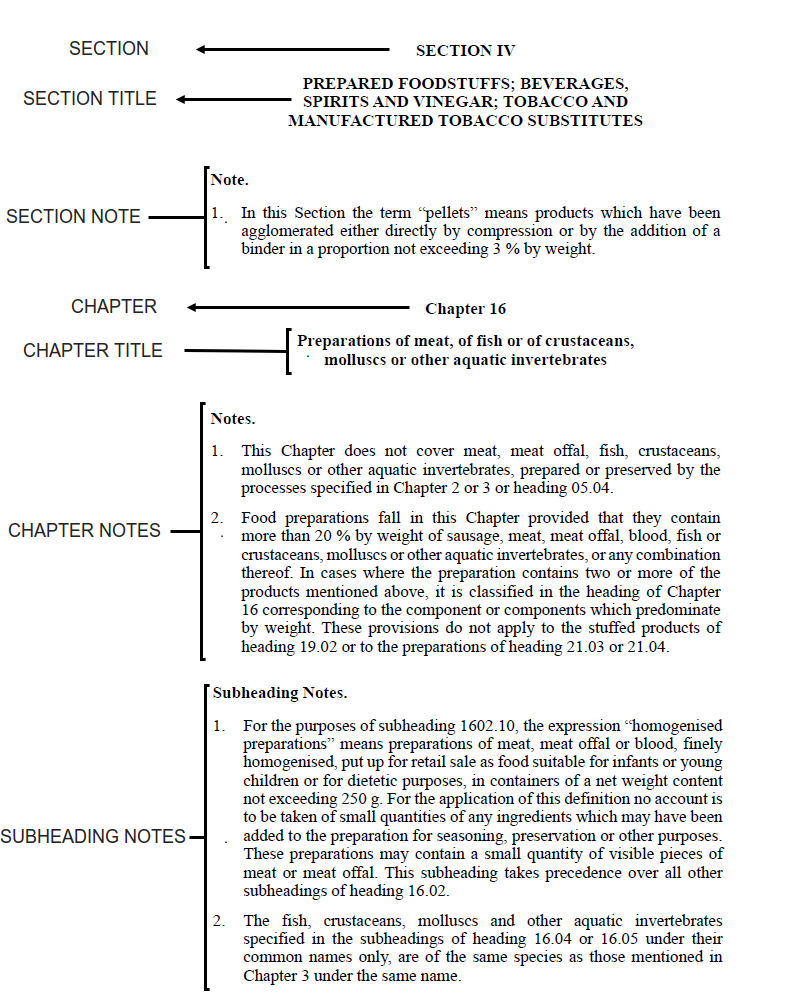

Rule 1 states that "Classification shall be determined according to the terms of the headings and any relative Section or Chapter Notes". Table of contents index, titles of sections and chapters are for ease of reference only.

For more information on HS Codes, click here to read our article on HS Codes.

You must only compare headings to headings and not headings to sub-headings. For example, classification for an electronic toothbrush:

Even though sub-heading 9603.21 describes "Tooth brushes", classification is more appropriate under a more specific heading which is "8509".

If the goods cannot be classified when applying GRI Rule 1, apply the next following GRI Rules orderly.

GRI Rule 2

a) This rule states that "Any reference in a heading to an article shall be taken to include a reference to that article incomplete or unfinished, provided that, as presented, the incomplete or unfinished article has the essential character of the complete or finished article". It should be taken.

Essential character basically looks to the nature and intended use of an article.

Here are some factors for determining "essential character":

Examples:

b) Headings which include mixtures or combinations as well as goods consisting wholly or partly of substances. Goods consisting of more than one material are classified according to GRI Rule 3.

GRI Rule 3

This rule states that "When by application of Rule 2 or for any other reason, goods are, prima facie, classifiable under two or more headings, classification shall be effected as follows". Prima facie basically means on the face of the item or on the first impression.

a) The heading which provides the most specific description shall be the preferred headings choice compared to a more generic description. Unless it refers to only part of the mixed substances or part of the items put up for retail sale.

For example, classifying a Steel Spoon:

Steel spoon is classified under the heading 8215 instead of 7323. Generally, we follow the "rule of specificity" the more specific heading is preferred as it can describe the goods with a greater degree of accuracy.

b) If the goods cannot be classified using 3 (a), "it shall be classified as if they consisted of the material or component which gives them the essential character".

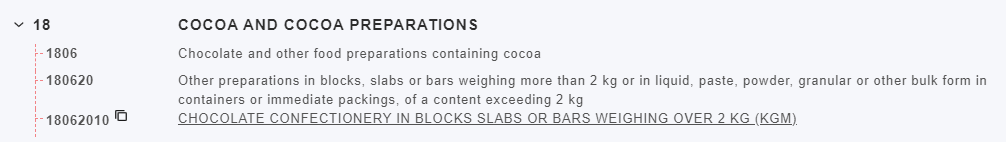

Example of a Liquor-filled chocolate:

The chocolate component would be considered as an "essential character", therefore even if it contains Liquor, it should still be classified under the 1806 heading.

c) When the goods cannot be classified using rule 3(a) or 3(b), they shall be classified under the heading which occurs last in the HS tariff system.

Examples of classifying a fishing rod and reel set put up for retail sale:

Classification of the fishing rod and reel set should be under 95073000 instead of 95073000 because, in customs evaluation of the rod and the reel, there is no essential character between the rod and the reel. Therefore, it should be classified based on which one is last on the HS tariff system.

GRI Rule 4

Goods that cannot be classified according to GRI 1 – 3 are to be classified in the heading applicable to the goods "to which they are most akin".

GRI Rule 5

a) This rule mainly focuses on cases such as camera cases, musical instrument cases, gun cases, etc. Goods that are suitable for long term use and are presented with the goods for which they are intended shall be classified with the goods themselves. This rule however does not include containers that give the whole its essential character.

b) Packing materials and packing containers will be classified with the goods that they are packing if they are the kind that is normally used for packing such goods. This does not apply if the packing materials or packing containers are clearly suitable for repetitive use. E.g. Fruits with plastic/Styrofoam packaging will be classified as fruits.

GRI Rule 6

This rule is used to classify products using subheading descriptions and any related subheading notes:

Conclusion

You have learned the following things about GRI in this article:

Generally, most goods should be able to be classified by utilizing GRI Rule 1-3 as it covers a wide range of descriptions. However, GRI rule 4 has slowly started to become more popular due to the speed of technological enhancement and the lack of speed on the updating of the HS System. Technologies that tend to blend multiple machines, manufacturing, and materials are starting to become more and more difficult to classify.

Ultimately, understanding what the GRI rules are and when to apply them will greatly increase the likelihood of correctly classifying your goods to the correct HS Code.

CALISTA Intelligent Advisory (CIA) GRI functionality has been released for beta testing with a selected user group. This new implementation aims to further enhance the accuracy of out HS Classification engine where the users are guided in a step-by-step approach to find the required HS Codes. Through this step-by-step process, our AI-powered HS Classification engine is able to recommend the best results at each level of the HS Code (Chapter/Heading/Sub-Heading/Dutiable HS Code), making it easier and more accurate for every user.